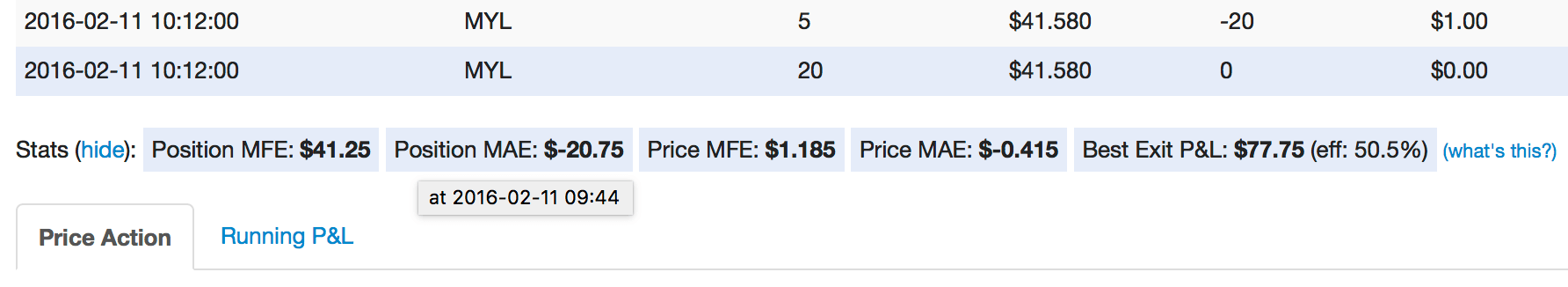

When viewing a trade, you can see the position and price excursion data (MFE and MAE) right below the execution list for the trade, as described in MFE and MAE calculations. This data can be extremely useful for seeing your maximum interim profit or loss in the trade, and in aggregate can be very useful for analyzing stops.

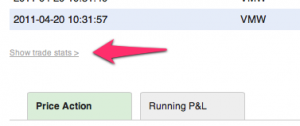

Today, we have added the ability to see exactly when the MFE/MAE occurred in a trade. Simply hover your cursor over the MFE or MAE value you’re interested in, and you’ll see a small popup with the timestamp it happened at:

Especially when looking at position MFE/MAE, it’s not always obvious on the price chart where this occurs, if you’re scaling in and out of a trade. Having the timestamp quickly accessible makes it much easier to find!

MFE/MAE data is available for all silver and gold subscribers.