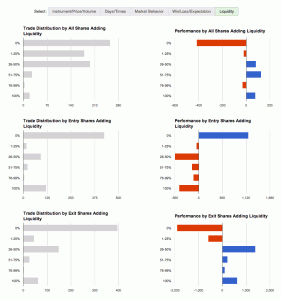

Some brand new reports are now available! These are designed to analyze the liquidity you are adding/removing from the market, and more importantly, look at your trading performance as it relates to liquidity.

A quick primer on what we mean by “liquidity”:

Removing liquidity – when you place a marketable order, you are removing or taking liquidity. Examples of this would be a market order, or a limit order where your bid is at or above the current offer (or offer at/below current bid).

Adding liquidity – non-marketable orders add liquidity. When you enter a bid or ask into the market, but it’s not immediately executable, it sits on the book and is considered adding liquidity.

The new Tradervue reports analyze this in your trading, and help you pinpoint your performance as it relates to liquidity. For example, if you trying hard to add liquidity, but you’re generally losing money when you do, perhaps you should re-think your approach.

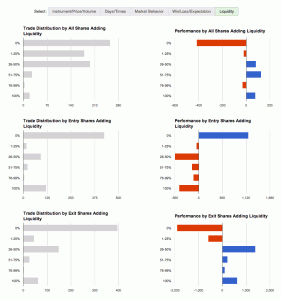

The first set of liquidity reports looks like this:

From top to bottom, your performance is plotted against:

– all shares in the trade that added liquidity

– entry shares that added liquidity

– exit shares that added liquidity

You can find those reports under the “Detailed” reports tab, as well as the “Win vs Loss” and “Compare” tabs. And these of course work with the usual filtering, so if you want to see your liquidity data for just short trades, or just AAPL trades, or compare your long vs short trades, that’s all at your fingertips.

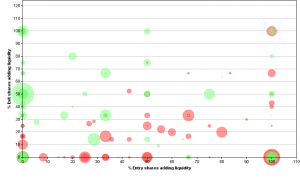

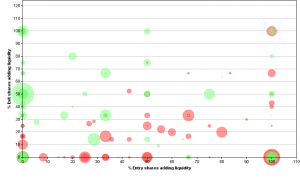

And second, under the “Advanced” tab, you can find a chart like this:

In this report, the X-axis is the % of entry shares adding liquidity, the Y-axis is the % of exit shares adding liquidity, and each trade is plotted with a circle. The larger circles are the larger wins/losses.

There is more detail on these reports, as well as the data requirements for using them, on the Liquidity Reports help page.

These reports require imported liquidity data from your broker or platform; at the current time, Lightspeed and PropReports both support this, as well as our generic import format.

The reports are available today for all gold subscribers!