The statistics table at the top of the detailed reports page now shows the maximum number of consecutive wins and losses:

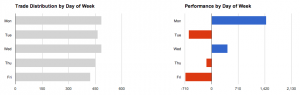

Each side has a “show” link – if you click on that link, you will see the particular sequence of trades that’s making up the consecutive win/loss streak. In addition, when you do this the global filter is modified to just show those trades; that means you can browse through the rest of the reports, and see data for only the particular sequence of trades.

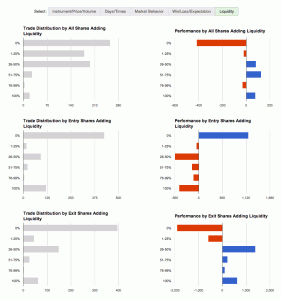

So for example, say you had a losing streak of 20 trades. If you click on the “show” link, you’ll see just those 20 trades. Then go back to the detailed reports page, and go to (say) the liquidity group – you might find your losing trades all have something in common that you didn’t expect.

Note that this, just like all other data in the statistics table, is reporting on the trades that are selected via the global filter bar. If you filter on just SPY trades, for example, the consecutive wins/losses will be just for the SPY trades.

The max consecutive wins and losses is available for all users – go take a look!